Investor Relations

Our Q1 numbers in a nutshell

with CEO Frans Muller & CFO Natalie Knight

PRESS RELEASE

Ahold Delhaize delivers solid Q1 2023 results, driven by its strong U.S. performance, continued customer loyalty and diverse global brand portfolio

-

Our brands' efforts to provide customers with the best value at competitive prices continue to deliver strong financial results. Through our Save for Our Customers cost-savings program and by continuing to invest in the expansion of low-cost, high-quality own-brand assortments and personalized benefits through digital omnichannel and loyalty programs, our brands are well positioned to best serve their customers and local communities during these challenging times of elevated inflation.

-

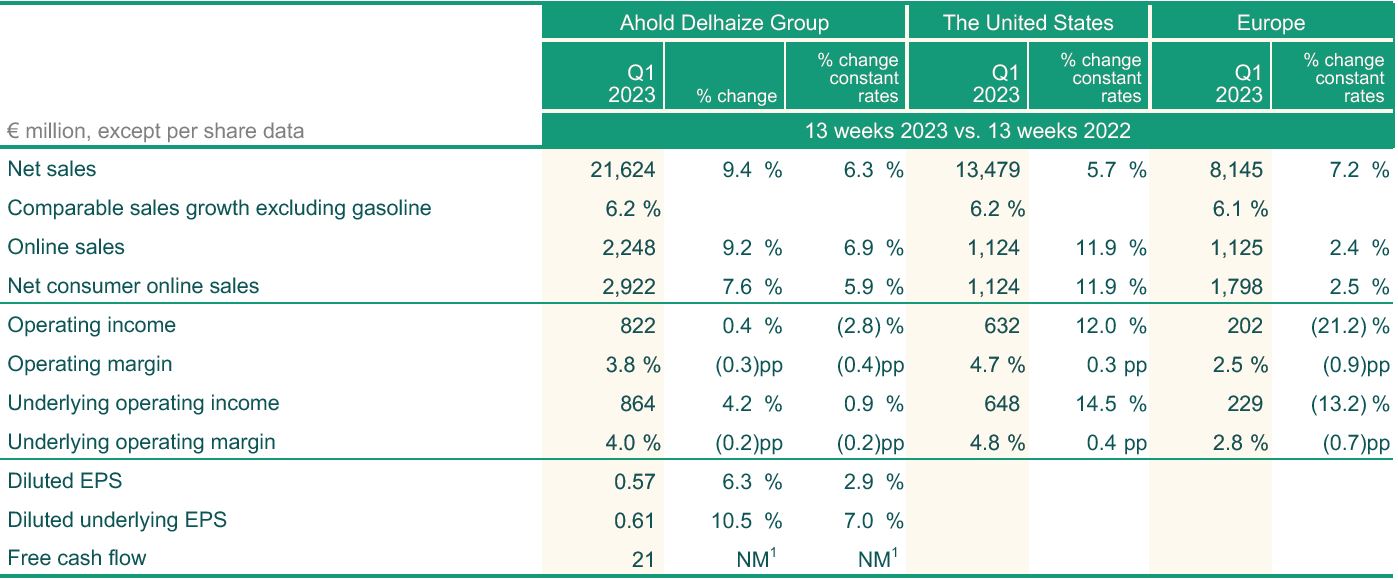

Q1 Group net sales were €21.6 billion, up 6.3% at constant exchange rates and up 9.4% at actual exchange rates.

-

Q1 comparable sales excluding gas increased by 6.2% in the U.S. and 6.1% in Europe.

-

Net consumer online sales increased by 5.9% in Q1 at constant exchange rates. Grocery online sales increased 9.7% at constant rates.

-

Q1 underlying operating margin was 4.0%, a decrease of 0.2 percentage points. Strong underlying U.S. margin partially offset declines in European margin and a reduction in GSO insurance gains.

-

Q1 IFRS-reported operating income was €822 million and Q1 IFRS-reported diluted EPS was €0.57.

-

Q1 diluted underlying EPS was €0.61, an increase of 10.5% over the prior year at actual rates.

-

The Company reiterates its 2023 full-year outlook, including underlying operating margin of ≥4.0%; underlying EPS at around 2022 levels; free cash flow of approximately €2.0 billion; and net capital expenditures of approximately €2.5 billion.

Zaandam, the Netherlands, May 10, 2023 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports first quarter results today.

- Not meaningful, as free cash flow was negative in Q1 2022.

Comments from Frans Muller, President and CEO of Ahold Delhaize

“Our brands' ability to adapt their assortments and omnichannel customer journeys to rising consumer price sensitivity is resonating well with customers, and this is clearly reflected in our Q1 results. Comparable store sales excluding gas grew 6.2% in Q1. Leveraging these strong sales, we delivered an underlying operating margin of 4.0% and diluted underlying EPS growth of 10.5%. Our strong earnings performance was largely driven by a strong operating performance in the U.S, which partially offset increased energy costs in Europe and the impact of strikes in Belgium.

“With the price/value equation of the utmost importance to customers in this inflationary environment, our brands continue providing the best value at competitive pricing for customers. This is reflected in strong and innovative assortments with a large variety of affordable and healthy options. On top of that, our brands' loyalty programs provide customers with highly personalized discounts to fit their needs. Together with our ongoing work with suppliers, the scale and leverage provided by our global portfolio, as well as our €1 billion Save for Our Customers program, we are keeping prices as low as possible.

“The U.S. brands continue to deliver consistent and strong performance. In the quarter, comparable sales grew by 8.1%, excluding weather and calendar shifts. We also delivered a strong underlying operating profit, driven by better shelf availability, as supply chains are much improved compared to a year ago. It is clear that customers are finding great value through our brands' various omnichannel propositions. During the quarter, the loyalty programs at Food Lion, Stop & Shop, and Giant Food were named among 'America's Best Loyalty Programs 2023’ by Newsweek.

“In Europe, excluding the impact of strikes in Belgium following the announcement by local management of their intention to transform its integrated supermarkets there into independently operated Delhaize stores, comparable sales were up 7.7%. Excluding the impacts of inflated energy costs and strikes, underlying operating margins modestly exceeded prior year levels.

"We know that customers value our omnichannel ecosystems, which offer them the flexibility and convenience of shopping whenever and wherever they want. Net consumer online sales increased by 5.9% during the quarter, with online sales in grocery up 9.7%. At bol.com, Gross Merchandise Value (GMV) excluding VAT was €1.3 billion, up 1.2% versus the prior year and a sequential growth rate improvement compared to Q4 2022. Now, having lapped the difficult COVID-19-related comparisons, we expect growth rates to materially improve going forward, as the business is powered by bol.com's three key business models: e-commerce, advertising and logistic services.

“We also remain strongly focused on our long-term sustainability agenda and we consider sustainable finance instruments to be key in supporting our efforts. In March, we successfully priced our inaugural Green Bond for €500 million. With this, Ahold Delhaize became the first corporate European borrower to issue three different ESG-related formats, confirming our ambition to set the pace in sustainable finance. The bond proceeds will be allocated towards projects contributing to our healthy and sustainable targets.

“As we look to the next quarters, our strong global portfolio of number one and number two local brands provides ample opportunities and cushion to navigate the environment. In the U.S., our brands are well positioned as inflation levels start to moderate. In Europe, although inflation rates remain in the double digits, our brands are taking the right measures to continue to raise the bar competitively to drive long-term relative market share gains. While some of these actions, like those initiated by Delhaize Belgium, take a lot of courage and are disruptive in the short term, I am confident these measures will also ensure the long- term success of our brands, for the benefit of all our stakeholders."

Q1 Financial highlights

Group highlights

Group net sales were €21.6 billion, an increase of 6.3% at constant exchange rates, and up 9.4% at actual exchange rates. Group net sales were driven by comparable sales growth excluding gasoline of 6.2%, and, to a lesser extent, by foreign currency translation benefits. Weather and calendar shifts, and, to a lesser extent, strikes in Belgium, had a negative net impact on Q1 Group comparable sales of approximately 1.8 percentage points.

In Q1, Group net consumer online sales increased by 5.9% at constant exchange rates, led by robust performance in the U.S., which increased 11.9% compared to the prior year. Net consumer online sales increased 2.5% in Europe. Group online sales in grocery increased 9.7% at constant exchange rates.

In Q1, Group underlying operating margin was 4.0%, a decrease of 0.2 percentage points at constant exchange rates. Strong underlying U.S. margin and decreased non-cash service charge for the Dutch employee pension plan, resulting from higher discount rates in the Netherlands, partially offset margin declines in Europe and a reduction in Global Support Office insurance gains. Excluding the impacts of inflated energy costs and strikes, underlying operating margin modestly exceeded the prior year. In Q1, Group IFRS-reported operating income was €822 million, representing an IFRS-reported operating margin of 3.8%, mainly impacted by restructuring and related costs from the Accelerate initiative and Belgium.

Underlying income from continuing operations was €593 million, an increase of 6.9% in the quarter at actual rates. Ahold Delhaize's IFRS-reported net income in the quarter was €561 million. Diluted EPS was €0.57 and diluted underlying EPS was €0.61, up 10.5% at actual currency rates compared to last year's results. In the quarter, Ahold Delhaize purchased 7.2 million own shares for €205 million.

U.S. highlights

U.S. net sales were €13.5 billion, an increase of 5.7% at constant exchange rates and up 10.5% at actual exchange rates. U.S. comparable sales excluding gasoline increased by 6.2%. Excluding weather and calendar shifts, U.S. comparable sales would have been 8.1%, continuing to highlight the momentum at all of our U.S. brands. Food Lion continues to lead brand performance, delivering its 42nd consecutive quarter of positive sales growth.

In Q1, online sales in the segment were up 11.9% in constant currency driven primarily by over 20% growth at Food Lion and The GIANT Company, which both opened four new click-and-collect locations during the quarter.

Underlying operating margin in the U.S. was 4.8%, up 0.4 percentage points at constant exchange rates from the prior year period, building on the strong performance in the prior quarter and higher on-shelf availability resulting from improving supply chains. In Q1, U.S. IFRS-reported operating margin was 4.7%.

Europe highlights

European net sales were €8.1 billion, an increase of 7.2% at constant exchange rates and 7.5% at actual exchange rates. Europe's comparable sales increased by 6.1%.

On March 7, Ahold Delhaize's Belgian brand, Delhaize, announced its intention to transform all of its integrated supermarkets in Belgium into independently operated Delhaize stores to strengthen its position in the country's competitive retail market. Ahold Delhaize supports the intention to transform to one aligned operating model, which will allow the brand to better serve customers in the long term. By having all stores operated by local entrepreneurs in the future, Delhaize will have a better opportunity to respond to local conditions. Following the announcement, Delhaize Belgium has been impacted by strikes. Excluding the impact of strikes, Europe's comparable sales increased by 7.7%.

In Q1, net consumer online sales increased by 2.5%. Online sales in grocery increased by 4.6%. At bol.com, gross merchandise value ("GMV") was €1.3 billion, a sequential growth rate improvement compared to Q4 2022. Bol.com's GMV sales from its nearly 52,000 third-party sellers increased by 3.7% in Q1, and represented 65% of sales.

Underlying operating margin in Europe was 2.8% in Q1, down 0.7 percentage points from the prior year mainly due to the impact of escalating energy costs and strikes in Belgium. Excluding these impacts, underlying operating margin in Europe modestly exceeded the prior year. Additionally, the non-cash service charge for the Netherlands employee pension plan decreased €17 million as a result of higher discount rates in the Netherlands. Europe's Q1 IFRS-reported operating margin was 2.5%, mainly impacted by restructuring charges of €15 million primarily related to Belgium.

Outlook

Ahold Delhaize reiterates the Group's 2023 outlook, which we announced when we published our Q4 2022 results. Underlying operating margin is expected to be ≥4.0%, in line with the Company's historical profile. Underlying EPS is expected to remain at around 2022 levels at current exchange rates. Free cash flow is expected to be approximately €2.0 billion. Net capital expenditures are expected to total around €2.5 billion, with increased investments in digital and online capabilities as well as healthy and sustainable initiatives. In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program in 2023, as previously stated.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to our share buyback and dividend programs, but, given the uncertainty caused by the wider macro-economic consequences of the war in Ukraine, will continue to monitor macro-economic developments. The program is also subject to changes resulting from corporate activities, such as material M&A activity.

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation. This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as continu(e)/(ing), well positioned, constant, outlook, consistent, know, expect, remain, consider, ambition, well positioned, short term, confident, intention, opportunity, risks, uncertainties or other similar words or expressions are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions, including high levels of inflation, on consumer spending; changes in consumer expectations and preferences; turbulence in the global capital markets; political developments, natural disasters and pandemics; climate change; energy supply issues; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to environmental, social and governance matters (including performance) and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; ransomware and other cybersecurity issues relating to the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; inability to obtain effective levels of insurance coverage; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.