Responsible Tax

At Ahold Delhaize, we seek to make a positive impact in the communities where our brands operate and be good neighbors. We do this by paying taxes in a way that takes into consideration social and corporate responsibility and the interests of all our stakeholders. Our overall tax approach is in line with Ahold Delhaize’s Business Principles, sustainability strategy and Code of Ethics.

Our tax policy, which applies to all consolidated group entities, consists of five main tax principles: transparency, accountability and governance, compliance, relationships with authorities and business structure. Our tax principles are aligned with The B Team’s Responsible Tax Principles, developed by a group of leading companies, with involvement from civil society, investors and representatives from international institutions. In 2017, The B Team brought together the heads of Tax from nine multinationals to develop the Responsible Tax Principles, which raise the bar on how businesses approach tax and transparency and help forge a new consensus around what responsible tax practice looks like.

Ahold Delhaize also complies with the principles included in the VNO-NCW Tax Governance Code. For further reference to how Ahold Delhaize complies with the Tax Governance Code, please refer to the document on the right.

Transparency

By paying our share of taxes in the countries where we have operations, we contribute to economic and social development in these countries. Also, with our total tax contribution, we support the UN Sustainable Development Goals (SDGs).

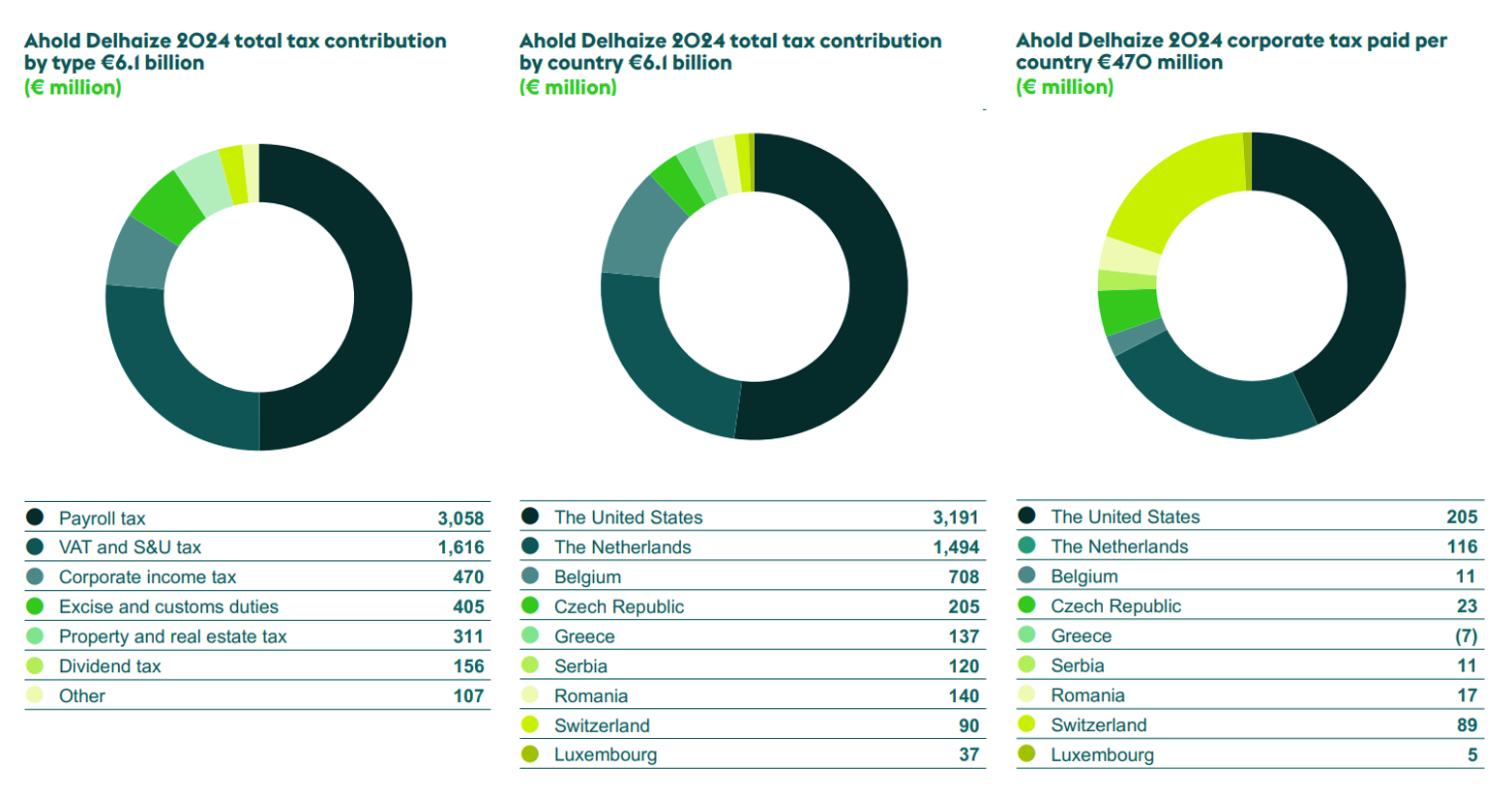

In 2024, Ahold Delhaize collected and bore many types of taxes: payroll tax, corporate income tax, net-value-added tax (VAT), sales and use (S&U) tax, property and real estate tax, dividend tax, excise and customs duties, and others (e.g., packaging tax), for a total amount of €6.1 billion. Approximately €1.9 billion of the Company’s total tax contribution

in 2024 relates to taxes borne.

The total tax contribution and corporate income tax payments that were reported per country are summarized below.

Our effective income tax rate (ETR) over 2024 was 21.7%. This is our worldwide income tax expense for the financial year 2024, amounting to €481 million, shown as a percentage of the consolidated income before income taxes.

Tax incentives

We define tax incentives as fiscal measures designed by governments to stimulate investment and encourage growth or a change in behavior by providing more favorable tax treatment to some activities or sectors.

For some of the activities that Ahold Delhaize and the brands undertake as part of our efforts to positively impact communities, there are tax incentives available, as described below.

Ahold Delhaize does make limited use of tax incentives. The main tax incentives applied by Ahold Delhaize in the various jurisdictions where our brands operate are:

Wage tax credits

Certain wage tax credits are available to companies that give opportunities to people who normally face difficulties finding employment, such as individuals with physical disabilities, as local governments seek to stimulate work participation in the labor market for these employees.

Capital investment credits

Local governments sometimes provide capital investment credits to stimulate investment (e.g., in warehouses or stores) in certain areas, to stimulate economic growth in their local communities.

Research & Development (R&D) incentives

Local governments sometimes provide R&D incentives to companies undertaking certain activities that increase the level of innovation and economic growth in their communities. We are always striving to innovate as we drive operational excellence, for instance, by optimizing stock in our brands’ DCs and stores. We receive R&D incentives for some of these activities.

Accountability and governance

Ahold Delhaize has a well-equipped and professional Tax function. It reports directly to the CFO and has direct access to the Management Board and the Supervisory Board. At least once a year, the function presents a tax update, including the implementation and execution of the tax strategy, to the Audit, Finance and Risk Committee of the Supervisory Board. The global tax policy is approved by the Management Board.

Our risk appetite is very low for tax purposes. We recognize the risk that non-compliance

with applicable tax laws and regulations could result in damage to Ahold Delhaize’s reputation or to the relationship with our host countries.

Tax in control statement

Being in control in relation to taxes and responsible taxation is an important objective for our Tax department and our Company.

We have certain activities in place to support this, including:

- We have a tax control framework to assess and control tax risks for the various taxes

and jurisdictions. - We define, implement and test tax controls resulting from our risk assessment exercises through our various monitoring functions – comprising senior management and the Risk & Controls (second line of defense) and Internal Audit teams – making use of specific Ahold Delhaize tools developed for this purpose.

- Based on the annual internal audit plan, we audit selected taxes and/or jurisdictions. This results in an audit report rating the design and operating effectiveness of our tax controls.

- We have a separate control framework for responsible taxation in place.

- (Local) management signs a letter of representation on a quarterly basis stating, among other things, that they are in compliance with all (tax) controls and policies.

- We hold frequent update meetings with local CFOs and business teams.

- We produce a tax compliance report.

- We organize continuous education for the Tax team and related functions.

Each quarter, our brands sign a letter of representation, which includes an approval and a confirmation on the accuracy and completeness of our tax position. We have a tax strategy in place that is proactively communicated throughout the Company, and we organize training for selected brands and jurisdictions, during which the tax policy and its main principles are explained through tax risk workshops.

On a regular basis, we monitor whether our tax strategy is aligned with the Ahold Delhaize Business Principles, sustainability strategy and Code of Ethics. For example, the Tax department’s annual objectives are based on the above mentioned principles and strategy

and cascaded to individual associates’ goals. Department and associate performance compared to these objectives is measured at least once per year.

Ahold Delhaize associates have access to a whistle-blower line for reporting any ethical

or compliance concerns related to Company practices, including tax matters.

We are also actively involved in the field of tax technology. We have drafted a global tax technology strategy and roadmap based on five pillars: insights, data driven, automation, risk management and future-proof. We set up various initiatives within our direct tax disciplines (such as country-by-country reporting automation, Pillar 2 calculations and a tax reporting engine) and indirect tax disciplines (such as a VAT solution and tax engine), to optimize and upgrade our tax processes. We closely align with broader finance implementations, such as a new core finance systems/finance consolidation systems and our IT function assists us with

our tax technology projects.

Compliance

- Our tax compliance is based on the following examples of good tax practices:

- We aim to file our taxes in full compliance with local laws and regulations.

- We base our tax compliance on a reasonable and responsible interpretation of tax laws.

- We aim to comply with the letter as well as the spirit of the law.

- We attempt to discuss and clarify uncertainties about the tax treatment upfront with the tax authorities.

- We only seek rulings from tax authorities to confirm the applicable treatment of laws and regulations based on full disclosure of the relevant facts.

- We only make use of tax incentives when they are aligned with our business and operational objectives, follow from the tax law and are generally available to all market participants.

Relationships with tax authorities

Ahold Delhaize engages with tax authorities based on mutual trust, and we seek open and transparent working relationships with them. We provide the tax authorities with any information they require within a reasonable timeframe. This helps both the tax authorities and Ahold Delhaize to foster timely and efficient compliance. In the Netherlands,

we have an individual monitoring plan in place with the Dutch tax authorities. In Belgium,

we participate in the Co-operative Tax Compliance Program (CTCP).

Stakeholder engagement

As a Company close to society, we value constructive dialogue on taxes with the governments in the countries where our brands operate and we respond to government consultations on proposed changes to legislation with the aim of achieving sustainable legislation.

In addition to the tax authorities, our stakeholders also include investors, customers, business partners, non-governmental organizations (NGOs), employees and the broader communities

in which we operate. We are an active member in a number of stakeholder representation groups such as the VNO-NCW and Nederlandse Orde van Belastingadviseurs. We also participate and provide active feedback in the Dutch Association of Investors for Sustainable Development (VBDO) tax transparency initiative. We actively participate in the European Business Tax Forum (EBTF) Total Tax Contribution Study.

Business structure

We have a physical presence in all jurisdictions where we operate and we follow internationally accepted norms and standards (e.g., OECD/Action Plan on Base Erosion and Profit Shifting/EU).

Our tax decision-making process is based on the following examples of good tax practices:

- We do not operate nor transfer value created to jurisdictions listed on the European

Union (EU) “blacklist” of non-cooperative jurisdictions for tax purposes updated by

the Council of the EU on October 8, 2024, or (low-tax) jurisdictions listed on the Netherlands’ blacklist published in the Government Gazette on December 19, 2024. - We pay tax on profits according to where value is created within the normal course

of business. - We base our transfer pricing policy on the arm’s length principle.

- We do not use opaque corporate structures or those situated in low-tax jurisdictions to hide relevant information from the tax authorities.

- We are transparent about the entities we own.

- We will not engage in arrangements with any employee, customer or contractor whose sole purpose is to create a tax benefit in excess of what is reasonably understood to be intended by relevant tax rules.