Zaandam, the Netherlands, December 4, 2018 – Koninklijke Ahold Delhaize N.V. (the “Company” or “Ahold Delhaize”) announced today the early results of its previously announced offer to purchase for cash up to $350,000,000 principal amount (the “Maximum Tender Amount”) of its 5.70% Senior Notes due 2040 originally issued by Delhaize Group NV/SA (which entity merged into the Company effective July 24, 2016) (the “Notes”). The Company refers to its offer to purchase the Notes as the “Offer”.

The terms and conditions of the Offer are described in the Offer to Purchase, dated November 19, 2018 (as it may be amended or supplemented from time to time, the “Offer to Purchase”).

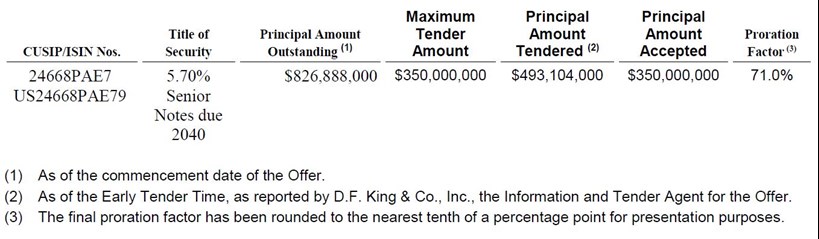

As of 5:00 p.m., New York City time, on December 3, 2018 (the “Early Tender Time”), $493,104,000 aggregate principal amount of Notes were validly tendered and not validly withdrawn. The table below identifies the principal amount of Notes validly tendered and not validly withdrawn and the principal amount the Company has accepted for purchase:

The amount of the Notes accepted for purchase was determined pursuant to the terms and conditions of the Offer as set forth in the Offer to Purchase.

Because the aggregate principal amount of Notes that were validly tendered and not validly withdrawn as of the Early Tender Time exceeded the Maximum Tender Amount, the Notes that were validly tendered and not validly withdrawn at or prior to the Early Tender Time will be accepted for purchase on a pro rata basis, and the Company will not accept for purchase any additional Notes tendered after the Early Tender Time. Notes not accepted for purchase will be promptly credited to the account of the registered holder of such Notes with the relevant Clearing System and otherwise returned in accordance with the Offer to Purchase.

Holders of Notes validly tendered and not validly withdrawn on or before the Early Tender Time and accepted for purchase will be eligible to receive the Total Consideration (as defined in the Offer to Purchase), which includes an early tender premium of $50 per $1,000 principal amount of Notes. The Total Consideration will be determined in the manner described in more detail in the Offer to Purchase by reference to a fixed spread (the “Fixed Spread”) specified for the Notes over the yield to maturity corresponding to the bid-side price of the Reference U.S. Treasury Security specified in the Offer to Purchase, as calculated by the Dealer Managers (as defined below) in accordance with standard market practice at 11:00 a.m., New York City time, on December 4, 2018 (subject to certain exceptions set forth in the Offer to Purchase, such time and date, as the same may be extended, the “Price Determination Date”). All payments for Notes purchased in connection with the Early Tender Time will also include accrued and unpaid interest from the last interest payment date for the Notes up to, but excluding, the Early Settlement Date, which is currently anticipated to be December 6, 2018. In accordance with the terms of the Offer, the withdrawal deadline was 5:00 p.m., New York City time, on December 3, 2018. As a result, tendered Notes may no longer be withdrawn, except in certain limited circumstances where additional withdrawal rights are required by law (as determined by the Company).

Although the Offer is scheduled to expire at 11:59 p.m., New York City time, on December 17, 2018, the Company does not expect to accept for purchase any tenders of Notes after the Early Tender Time because the aggregate principal amount of Notes that were validly tendered and not validly withdrawn as of the Early Tender Time exceeded the Maximum Tender Amount.

This press release, including the following, is qualified in its entirety by the Offer to Purchase.

J.P. Morgan Securities LLC and Merrill Lynch International are acting as the dealer managers (the “Dealer Managers”) for the Offer. The information and tender agent for the Offer (the “Information and Tender Agent”) is D.F. King & Co., Inc.

Requests for documentation for the Offer should be directed to D.F. King & Co., Inc. at (866) 342-8290 (U.S. toll-free) or (212) 269-5550 (banks and brokers) or by email at AD@dfking.com. Questions regarding the Offer should be directed to J.P. Morgan Securities LLC at (866) 834-4666 (toll-free) or (212) 834-8553 (collect) or Merrill Lynch International at (888) 292-0070 (US toll-free), (980) 387-3907 (US collect), +44 29 7996 5420 (in Europe) or DG.LM_EMEA@baml.com (by email).

Capitalized terms used but not defined in this announcement have the meanings given to them in the Offer to Purchase.

This press release is neither an offer to purchase nor a solicitation to buy any of the Notes nor is it a solicitation for acceptance of any of the Offer. Ahold Delhaize is making the Offer only by, and pursuant to the terms of, the Offer to Purchase. The Offer is not being made to (nor will tenders of Notes be accepted from or on behalf of) holders of Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the securities or “blue sky” laws require offers to be made by a licensed broker or dealer, any offer will be deemed to be made on behalf of Ahold Delhaize by the Dealer Managers, or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction. This announcement must be read in conjunction with the Offer to Purchase. None of Ahold Delhaize, the Dealer Managers or the Information and Tender Agent makes any recommendation as to whether holders should tender their Notes pursuant to the Offer.

The distribution of this press release in certain jurisdictions may be restricted by law. Persons into whose possession this press release comes are required by each of the Company, the Dealer Managers and the Information and Tender Agent to inform themselves about and to observe any such restrictions.

United Kingdom

The communication of the Offer to Purchase and any other documents or materials relating to the Offer has not been approved by an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000 (the “FSMA”). Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials is exempt from the restriction on financial promotions under section 21(1) of the FSMA on the basis that it is only directed at and may only be communicated to (1) those persons who are existing members or creditors of the Company or other persons within Article 43(2) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, (2) persons outside the United Kingdom, and (3) any other persons to whom such documents and/or materials may lawfully be communicated in circumstances in which section 21(1) of the FSMA does not apply to the Company (all such persons together being referred to as “Relevant Persons”). Any investment or investment activity to which such documents and/or materials relates is available only to and will be engaged in only with Relevant Persons, and any person who is not a Relevant Person should not rely on them.

Belgium

Neither the Offer to Purchase nor any other documents or materials relating to the Offer have been submitted to or will be submitted for approval or recognition to the Financial Services and Markets Authority (Autorité des services et marchés financiers / Autoriteit voor financiële diensten en markten) and, accordingly, the Offer may not be made in Belgium by way of a public offering, as defined in Articles 3 and 6 of the Belgian Law of April 1, 2007 on public takeover bids as amended or replaced from time to time (the “Belgian Takeover Law”). Accordingly, the Offer may not be advertised and the Offer will not be extended, and neither the Offer to Purchase nor any other documents or materials relating to the Offer (including any memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or indirectly, to any person in Belgium other than “qualified investors” as referred to in Article 6, §3 of the Belgian Takeover Law and as defined in Article 10 of the Belgian Law of June 16, 2006 on the public offer of investment instruments and the admission to trading of investment instruments on regulated markets, acting on their own account and provided that any such person does not qualify as a “consumer” within the meaning of the Belgian Code of 28 January 2013 on economic law, as amended or replaced from time to time. The Offer to Purchase has been issued only for the personal use of the above qualified investors and exclusively for the purpose of the Offer. Accordingly, the information contained in the Offer to Purchase may not be used for any other purpose or disclosed to any other person in Belgium.

France

The Offer is not being made, directly or indirectly, to the public in France. Neither the Offer to Purchase nor any other documents or offering materials relating to the Offer, has been or shall be distributed to the public in France and only (i) providers of investment services relating to portfolio management for the account of third parties (personnes fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (ii) qualified investors (investisseurs qualifiés) acting for their own account, other than individuals, all as defined in, and in accordance with, Articles L.411-1, L.411-2 and D.411-1 of the French Code monétaire et financier, are eligible to participate in the Offer. The Offer to Purchase has not been submitted to the clearance procedures (visa) of the Autorité des marchés financiers.

Italy

None of the Offer, the Offer to Purchase or any other documents or materials relating to the Offer has been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (“CONSOB”), pursuant to applicable Italian laws and regulations.

The Offer is being carried out in the Republic of Italy (“Italy”) as an exempted offer pursuant to article 101-bis, paragraph 3-bis of the Legislative Decree No. 58 of February

24, 1998, as amended (the “Financial Services Act”), and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of May 14, 1999, as amended (the “CONSOB

Regulation”). The Offer is also being carried out in compliance with article 35-bis, paragraph 7 of the CONSOB Regulation.

Holders or beneficial owners of the Notes located in Italy can tender the Notes through authorized persons (such as investment firms, banks or financial intermediaries permitted to conduct such activities in Italy in accordance with the Financial Services Act, CONSOB Regulation No. 20307 of February 15, 2018, as amended from time to time, and Legislative Decree No. 385 of September 1, 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB or any other Italian authority.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in connection with the Notes or the Offer.

Statements that are included or incorporated by reference in this press release and other written and oral statements made from time to time by Ahold Delhaize and its representatives, other than statements of historical fact, which address activities, events and developments that Ahold Delhaize expects or anticipates will or may occur in the future, including, without limitation, statements about its intention to accept validly tendered Notes in the Offer, are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements generally can be identified as statements that include phrases such as “outlook”, “expect”, “anticipate”, “will”, “should” or other similar words or phrases. There is no assurance that Ahold Delhaize will successfully complete the Offer as presently intended. Actual outcomes and results may differ materially from those projected depending upon a variety of factors, including, but not limited to, risks relating to competition and pressure on profit margins in the food retail industry; the impact of the Company’s outstanding financial debt; future changes in accounting standards; the Company’s ability to generate positive cash flows; general economic conditions; the Company’s international operations; the impact of economic conditions on consumer spending; turbulences

in the global credit markets and the economy; the significance of the Company’s U.S. operations and the concentration of its U.S. operations on the east coast of the U.S.; increases in interest rates and the impact of downgrades in the Company’s credit ratings; competitive labor markets, changes in labor conditions and labor disruptions; environmental liabilities associated with the properties that the Company owns or leases; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; exchange rate fluctuations; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations in the U.S., the Netherlands, Belgium and other countries; product liability claims and adverse publicity; risks related to corporate responsibility and sustainable retailing; the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; its inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; unexpected outcomes with respect to tax audits; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; natural disasters and geopolitical events; inherent limitations in the Company’s control systems; the failure or breach of security of IT systems compromising operations and critical Company data; a lack of security around, or non-compliance with, privacy requirements for customer or associate data; changes in supplier terms; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; adverse results arising from the Company’s claims against its self-insurance programs; and increase in costs associated with the Company’s defined benefit pension plans. Additional risks and uncertainties that could cause actual results to differ materially from those stated or implied by such forward-looking statements are described in the Offer to Purchase and Ahold Delhaize’s Annual Report for the fiscal year ended December 31, 2017 and other public filings and disclosures made by Ahold Delhaize. Ahold Delhaize

disclaims any obligation to update developments of these risk factors or to announce publicly any revision to any of the forward-looking statements contained in this release, or to make corrections to reflect future events or developments.