Ahold Delhaize presents Leading Together growth strategy at Capital Markets Day in New York

Click here for more information (presentations) about the Capital Markets Day

Ahold Delhaize presents Leading Together growth strategy at Capital Markets Day in New York

- Driving comparable sales growth and market share gains

- Doubling net consumer online sales to around €7 billion by 2021

- Repositioning Stop & Shop, its largest brand

- Saving €1.8 billion from 2019 through 2021 with Save for Our Customers

- Delivering high single-digit EPS growth with a stable group margin in 2019

- Generating around €2 billion in free cash flow annually, 2019 through 2021

New York City, November 13, 2018 – Ahold Delhaize today introduces its Leading Together strategy at the 2018 Capital Markets Day in New York City. Supported by its great local brands, best-in-class cash generation and balanced approach to capital allocation, this comprehensive strategic program focuses on driving comparable sales growth and market share gains over the next three years.

Frans Muller, President & CEO of Ahold Delhaize, said: “The merger and integration of Ahold and Delhaize Group have created a strong and efficient platform for growth, while maintaining strong business performance and building a culture of success. In an industry that’s undergoing rapid change, fueled by shifting customer behaviour and preferences, we will focus on growth by investing in our stores, omnichannel offering and technological capabilities which will enrich the customer experience and increase efficiencies. Ultimately, this will drive growth by making everyday shopping easier, fresher and healthier for our customers.”

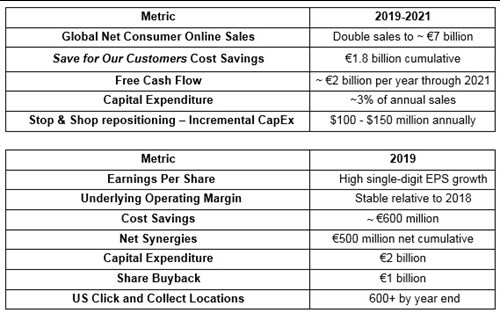

In the next three years, Ahold Delhaize expects to deliver comparable sales growth and market share gains as well as a doubling of net consumer online sales to around €7 billion by 2021. While investing in growth, the company will maintain a disciplined approach to capital investment and allocation, supported by a €1.8 billion cumulative Save for Our Customers cost program through 2021 and free cash flow of around €2 billion per year from 2019 to 2021. Capital expenditure will be around 3% of annual sales during the coming three years.

Frans Muller: “Our commitment is to self-fund the investments needed to drive growth, as our new cost savings program will allow us to maintain a stable group margin through 2019. This will allow us to invest in our stores, omnichannel offering and technology, while we explore and seize new leadership opportunities in existing and adjacent markets.”

For 2019, Ahold Delhaize expects a stable group margin and high single digit EPS growth, while buying back €1 billion of its own shares. To fund investments in the repositioning of its largest U.S. brand, Stop & Shop and in the speed and coverage of its delivery and click and collect network, capex is expected to be €2 billion.

Further details will be provided during the Capital Markets Day presentations, which will be posted on www.aholddelhaize.com starting at 8:00 AM EST. There will be an audio webcast available on the website as well.

Please see the following overview of guidance that management will share during the presentations at the 2018 Capital Markets Day.

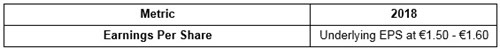

In addition, Ahold Delhaize is now in a position to provide EPS guidance for 2018 and reiterate guidance items provided in our Q3 earnings release earlier this month.

Look here how our great local brands are making everyday shopping easier, fresher and healthier for customers:

Cautionary Notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU

Market Abuse Regulation.

This communication includes forward-looking statements. All statements other than statements of historical facts may be

forward-looking statements. Words or expressions such as by 2021, from 2019 through 2021, in 2019, over the next three years, will, will focus, will enrich, will drive, expects/expects to deliver, will be, through 2019, will allow, expected to be, will maintain, guidance or other similar words or expressions are typically used to identify forward-looking statements. Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the risk factors set forth in the Company’s public filings and other disclosures. Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made and the Company does not assume any obligation to update such statements, except as required by law.